Contents:

Despite the ups and downs of the global economy, fintech startups are still an attractive target for investors. You’re probably here because you`re an expert in the financial domain, and you’ve decided to join the fintech race. Are you looking for the support of tech specialists whose experience and knowledge will contribute to your project’s success? If so, then you’re on the right track.

In this guide, we’ll give you some insights into what it takes to create AI money management apps and how to do it competently and effectively.

We can divide all the variety of AI financial management apps into two main kinds: apps for individuals and apps for businesses. In this article, we’ll discuss both cases.

AI Functionality for Building a Financial App

We want to start this guide with the best part. Next, we’ll describe the key features you should ensure when you create your own budget app. We`ll do this separately for the personal financial assistant and the business financial management app. AI capabilities are the centerpiece of the IT products we consider. So, first, let’s discuss more about them.

The use of artificial intelligence makes the difference between a powerful financial assistant and an ordinary money management app.

Here are three ways to make your budget app more intelligent:

1. BIOMETRIC AUTHENTICATION

The security of your financial app is precisely the area where artificial intelligence can shine in all its glory. You will have to offer users something much more advanced than passwords. After all, fintech app security is not just about preventing data leaks. At stake is also the peace of mind and confidence of users. They should feel psychologically comfortable using your budget app. AI-based software instills the necessary confidence. Today, biometric authentication technology is one of the most reliable methods of data protection. Attackers can easily choose the correct passwords with the help of modern algorithms. But many intruders can’t handle forging unique physical characteristics of users.

Biometric authentication can be done through face recognition, voice verification, iris scanning, or fingerprint identification. Each method has its own peculiarities of implementation. For example, iris scanning requires special equipment. The camera parameters of ordinary devices such as smartphones or computers are often insufficient for such scanning. In contrast, face recognition and voice verification do not have stringent hardware requirements.

2. CONVERSATIONAL ENGINE

Artificial intelligence development sometimes seems like something on the verge between technology and a miracle. A digital financial assistant can also be an interlocutor with a human voice.

Users have various preferences and habits. You will need to give users the option to choose how to get information from the application. In some cases, it is not ideal to find the necessary information on the screen. It is easier for users on the go to ask, “Hey, what is my credit card balance?” and get a voice answer.

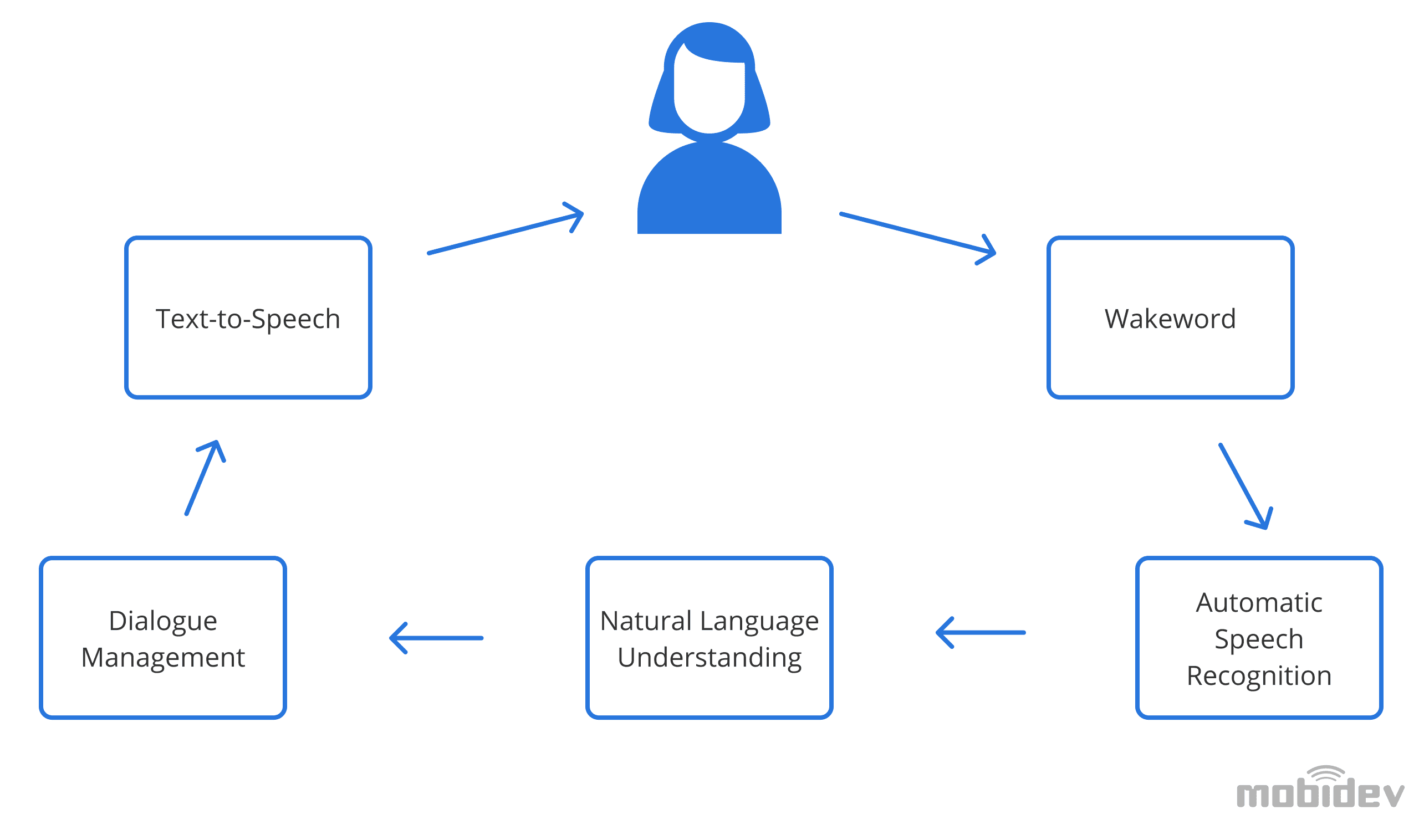

The AI-powered conversational engine ensures seamless communication between a financial app and its users. Two technologies play a central role: Natural language processing (NLP) and Natural Language Understanding (NLU). There is a magic word here called wakeword. This special command triggers the promised miracle of human communication with the financial app.

In the image, you can see how the conversational engine software module for AI financial management app works.

A properly trained conversational engine makes a financial app easy to use and increases user engagement. We develop such modules with our deep in-house expertise in Machine Learning (ML), a subfield of AI.

3. RECEIPT RECOGNITION

We receive financial documents in various formats. The need to manually transfer data from paper to a device is reminiscent of the days when you recorded your expenses in spreadsheets. And if you take into account how much time it took to search for the errors that inevitably happened, then these memories may not be so pleasant.

It turns out that the recipient recognition feature will make your finance app more user-friendly. The situation with an AI-based financial assistant increasingly resembles a live interview with a candidate for a similar position.

Here’s your recruiter asking candidates if they know how to use a scanner. Allow us to answer this question for a digital assistant. Yes, we make a budget app so that it can scan receipts, automatically inputting data about expenses.

To do this, we use optical character recognition (OCR) technology, which converts scanned images into text and numbers. Such a feature of the financial app reads the seller of goods or services, the date, and the amount of the payment. Expenses confirmed by a scanned receipt will be automatically entered into the expense report.

Recognizing and analyzing information from receipts is not easy. Therefore, this is an issue for AI, namely for advanced ML models. Due to such models, it is possible to process various types of documents, and, if necessary, manually correct the OCR output data to obtain a more accurate result.

So, for a visual example, we have listed three advanced AI-based features. They fit both for an individual robo-advisor and for a business solution.

In fact, AI in corporate finance provides even more opportunities since this sector is more multifaceted and specific. That’s why later, in this article, we will return to this topic, talking about AI financial management tools for companies.

Properly designed AI finance apps can become a full-fledged substitute for “human” financial consultants. Sooner or later, there comes a point when you feel the need for a solution with a good customer experience without human error and the bus factor. From this moment, it is time to determine how to create a financial app enriched with AI features.

Personal Finance App Development

A personal finance app or a personal financial assistant is an application that helps users manage their money more intelligently. Such an app can perform a wide range of tasks, from monitoring expenses and income to advising on the most suitable investment options. Some apps can also manage subscriptions and get better rates for users. For example, TrueBill automatically scans a user’s bills and looks for the best ways to save.

Artificial intelligence-driven virtual financial assistants can be both standalone applications or software connected to personal banking accounts. In the second case, the user will get more opportunities to control and manage their expenses and income, since the software will automatically pull up the data such as transaction history.

Due to Open banking standards, banks and financial apps may securely exchange user data with their consent. This scenario helps to automate the data flow and get more meaningful insights for better financial advice.

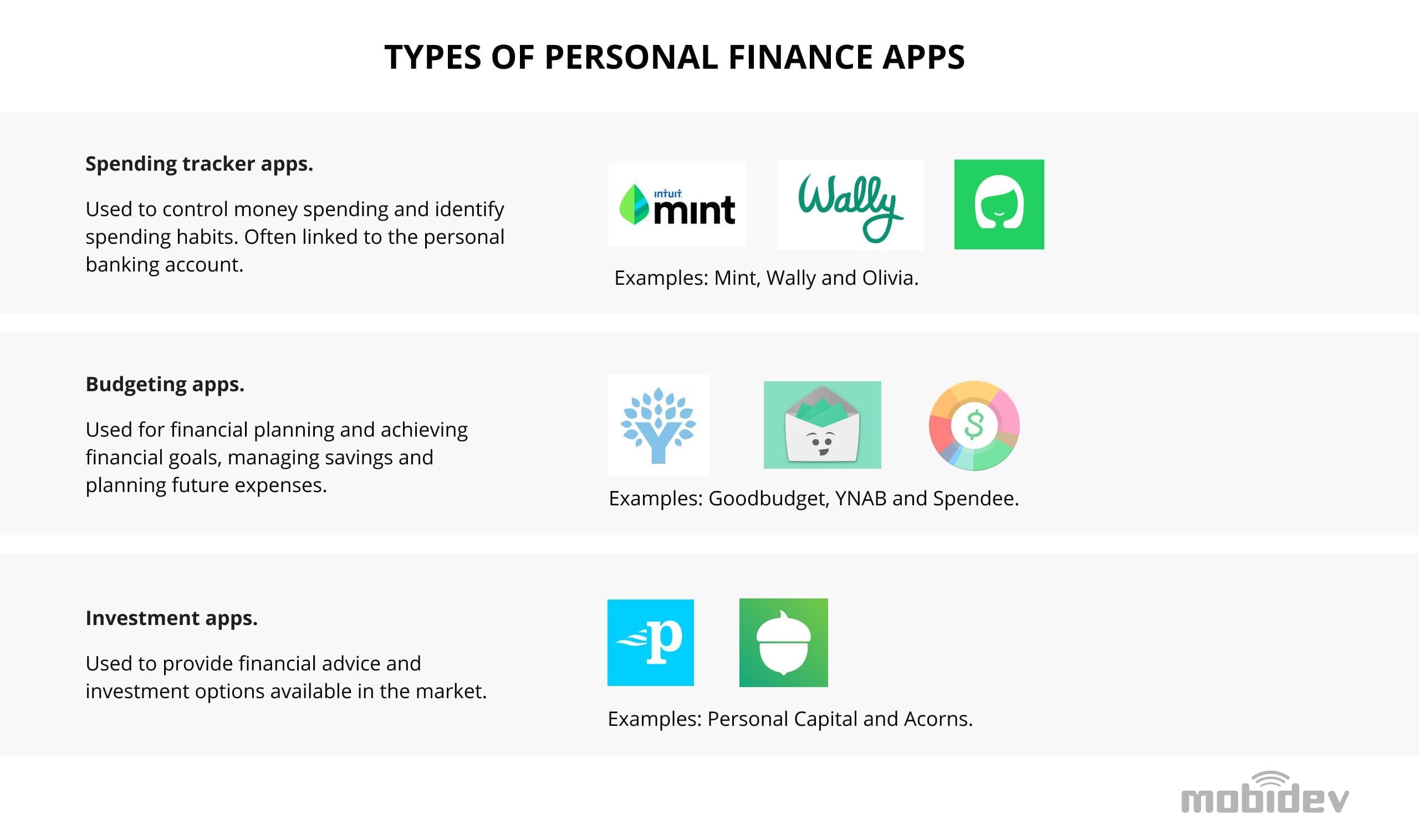

Types of Personal Financial Apps

Before we delve into how to build a financial app, let’s find out what types of such software are on the market.

It is worth noting that most personal finance applications combine several types in one. It`s a way to provide a better user experience and offer comprehensive financial management services. A little further on, we will not only talk about such a multi-solution but also show how it works.

Key Features of a Personal Finance Assistant App

You already know about AI-based advanced features for your AI personal financial assistant. Let’s also note the basic functionality of any money management app.

Here are features that users expect to see by default in a financial assistant app. We accompany the list of features with relevant tips on how to properly implement them:

Basic functionality of the money management app

- Registration/Log In. Implement two-factor authentication using biometrics. Single Sign-on (SSO) will also be appropriate. This provides secure user authentication with a single set of credentials for multiple apps.

- User profile. Personalization will improve the user experience. For example, allow users to personalize the app theme, select notifications, and more.

- Tracking expenses. The data for the expense report can be taken from a transaction history if the app is integrated with banking software. Data extraction from receipts using OCR and manual input are also possible.

- Integration with banking accounts.

- Categorization and budgeting. Suggest a basic list of default monthly expense categories. Provide users with opportunities to expand and add detail to this list.

- Setting financial goals. Set a basic list of default goals and allow the user to expand, drill down, and modify it.

- Investment and savings. Help users automate investing. They may set a spending limit, accumulate spare change from daily purchases, or send some part of the income to an investment account. You can also develop and implement an AI-powered investment robo-advisor module.

- Analytics and reports. High-quality visualization of reports facilitates users’ understanding of their financial situation.

- Notifications and alerts. Let users choose and customize the types of messages and reminders they want to receive.

To what extent do your ideas about the functionality of a financial robo-advisor coincide with what we talked about? Get in touch to discuss it.

Let's discuss your project!

Contact usCase study for a Family Finance Management App

What we see, we believe. Let’s look at how to make a budget app in a real-world example. The same case study shows how this financial solution, developed by MobiDev, operates.

The US-based startup founder came to us to make a budget app for families. He conceived the platform to help families track and analyze financial flows and plan a budget. The technological embodiment of his idea was completely entrusted to us. The family finance platform Pocket Account is the fruit of our joint efforts.

AI financial advisor app development for a family has its own game rules. The app should be accessible for comfortable use by all family members. An intuitive solution, a friendly UI/UX design is the basis of making a budget app for home use.

It is appropriate to look at these key points of the project:

1. Customizable complex chain of budget allocation rules

In our software, families configure the automated distribution of their budgets. All areas of funds management are present. The platform encompasses regular current payments, one-time expenses, savings, investments, and more.

It is possible to create chains of money distribution rules, even complex ones. Keeping in mind that a family is a small corporation, we have implemented a hierarchy of access and permissions.

Corporate bosses (parents) can control the overall family and personal budgets. They can easily set up one-off and recurring payments for each user. Access to information is as customizable for each person as the management of bank accounts. Privacy in finance is respected everywhere, so the application developed by MobiDev will help to keep information within the family.

2. An architecture conducive to scalability and future upgrades

We chose Event-driven architecture (EDA), which consists of decoupled services. Applying such an architectural solution facilitates scaling, upgrading, and deployment. You can do all this for only certain parts of the system without affecting others. This way, you can implement new app features faster in the future. It is possible to arrange an improvement pipeline. Continuous enrichment of functionality will occur by adding, first of all, AI-based features.

A decoupled data approach positively impacts fault tolerance and resilience of the system. In addition, EDA contributes to the agility of development. The ability to decompose complex processes also speeds up and simplifies programming.

3. Reducing time-to-market

When agreeing with the customer about how to make a budget app, we identified reducing the time-to-market as one of the priorities. In addition, as you remember, the platform is intended for all family members. That`s why we opted for a cross-platform approach.

Flutter is always worth considering as one possible option for cross-platform apps. With this software development kit (SDK), you can develop applications for iOS, Android, macOS, Linux, Windows, Google Fuchsia, and the web.

In the Pocket Account case, we involved Flutter developers in the project to optimize the schedule. The thing is that this technology provides simultaneous and independent development of app services. Given the need to create an intuitive, easy-to-use UI, Flutter was also a great fit.

4. Integrations with bank accounts

We used Plaid as the principal element of integration with bank services. When building a finance app, you can’t do without the integration of a 3rd-party solution for users to manage their bank accounts. The integration with Plaid has become one of the key points of our AI financial management product. This technological platform connects the application with bank accounts. Users can receive information from accounts and make payments without ceasing the use of the family finance app.

Project stakeholders chose Plaid because of its prevalence. Applying this solution allows you to interact with 70% of US and Canadian banks. The Pocket Account will not leave overboard clients of financial institutions not covered by Plaid. Our team will perform integrations with the IT systems of specific banks in the next releases of the app.

Here, you can view a demo video of the Pocket Account. Now, seeing our client’s idea implemented, you are one step closer to creating your own budget app.

We showed you a test drive of the family financial platform and let you take a look under its hood. Meet the team.

If your startup idea is a business financial management app, then we can move on to the most exciting part of all of this for you.

Building a Corporate Financial App for Business

AI in corporate finance may strikingly speed up and improve money decision-making. A cool app always resembles its user. Small and medium-sized businesses do not tolerate being overstaffed. Under one digital shell, the app can also have many helpful features:

- automated analytics

- real-time financial information

- advice and offering options for solutions

- data visualization, and so on, depending on your product vision

Day by day, the managers balance cash flows, assess and mitigate financial risks, analyze KPIs, keep stakeholders posted, and more. Such a corporate financial assistant facilitates founders and managers with their day-to-day tasks.

You are already aware of what these applications can be for family budgets. Now let’s focus on the differences in financial corporate solutions.

Key Features of an AI Financial Management App for Business

The financial component is present in all areas of the company’s activities. It follows that a businessman needs more than just an expense tracker or an ATM screen in his pocket.

Here are the principal expectations of business for the functionality of a corporate application for financial management:

- Strategic financial planning

- Consideration in the planning of macroeconomic and sectoral data. Perhaps the smart financial assistant will tell you in time that a recession has appeared on the economic horizon. So it’s time to get out of the comfortable “business as usual” mode. It’s time to cut costs, create reserves, and look for alternative sources of income.

- Cost-effectiveness analysis

- Highlighting bottlenecks and problem areas in financial flows.

- Analytics of the company’s sales histories and relationships with buyers and suppliers.

- Recommendations on investments of temporarily free funds. Portfolio investment options, including targeting the world’s leading indices, as well as stockbroker integration. In a word, the entire investment toolkit up to NFTs and cryptocurrencies.

- Continuous monitoring and comparison of planned and actual financial data. The balance of the account is a very simple and, at the same time, insidious indicator. It lulls attention and creates the illusion that everything is going well.

Luckily, the app has a good memory and remembers what expenses your company will face. However, an AI-based corporate financial assistant is not an alarm clock and is not Mr. No. It can suggest several solutions, giving a choice. Especially if the user took care of the introduction of inputs and prioritization. For example, “Yes, overbudgeting has come on marketing expenses. But I do not advise reducing them”. The user is like, “Wow! But how?!”

And then, the app reports that current global and regional trends show that the recession will affect the company’s large clients. They will inevitably cut costs and possibly even freeze purchases. In this situation, it is better to diversify the order book, finding new customers from regions and industries that will be less affected by the downturn. Therefore, it is likely better not to touch the marketing budget, but here is the proposed list of expenditure items for cutting.

(Disclaimer: We ask that any coincidence with your nonfictional conversation with a financial adviser yesterday be considered accidental).

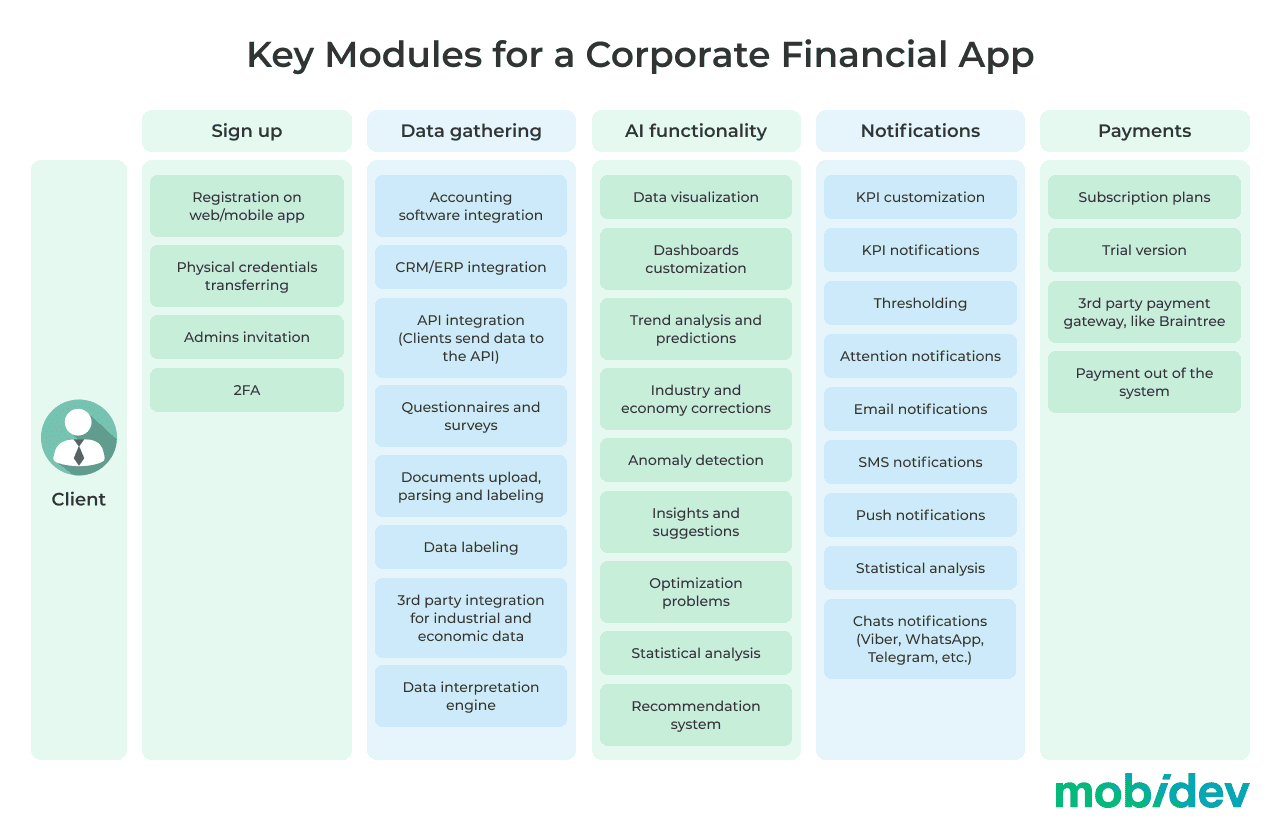

Next, we will provide the list and configuration of functional modules of the corporate finance management app. A custom set of such modules can form the basis of your business finance app.

Let’s list and comment on five peculiar properties of AI money management apps for companies:

1. Automated Data Gathering

The difference when compared to personal financial digital tools in this area is clearly visible. Manual input and scanning prevail in apps for individuals. In addition, the integration according to Open Banking standards, which we talked about above, can be used.

There are large volumes of data in corporate finance solutions. Input channels that work in software for individuals cannot cope with such pressure. It is advisable to keep in the corporate app the possibility of manual input in cases of need and crawling with subsequent OCR processing.

Such data collection methods will sometimes help. Uploading and parsing files in spreadsheet formats will also be useful. The system can be trained to analyze, identify and distribute the data contained in such files to appropriate databases. But the main data flows will go to the business financial assistant due to integrations with third-party software.

2. Integration of Third-Party Solutions

Integrations are the core element of AI money management apps for businesses. At least three factors cause this need:

- Bank account management. Users definitely want to see account balances and make payments without leaving the app. Integration with the software of banks and payment systems is mandatory.

- Data ingestion is crucial. Priority in this area is given to accounting software, such as QuickBooks, Kashflow, Xero, Freshbook, Sage, and others. Much valuable information is also accumulated in ERP and CRM systems (SAP, NetSuite, Odoo, Zoho, etc.).

- Data exchange of the financial application with other IT products of the user company is two-way. Seamless information flow between all software systems ensures a positive customer experience.

In AI budgeting app development, there are two main approaches for integrations with already existing IT systems:

- Applying API or SDK offered by vendors of popular software

- Building and implementing custom APIs or SDKs

The app ingests data in various formats. Therefore, data validation and data set formation are essential. Correct data processing often requires the creation of a specific data interpretation engine. Choose the format that is most convenient for processing by the program and, in particular, by its built-in AI models. The interpretation engine brings data to a single format and checks database filling. It is substantial to avoid gaps in financial data that negatively affect the quality of analysis.

3. App Proactivity

The intensity of interaction with a corporate application is much higher than with a personal financial assistant. A personal robo-advisor patiently waits for the user to remember its existence. Information from it comes at the user’s request.

Many more events take place in companies every day. Sometimes you need to react to changes in the business environment in a flash. Outdated information is not even worth the time spent reading it and is only annoying. Conversely, timely advice will prevent trouble. “Forewarned is forearmed.” These challenges could be a delay in a large client payment, a change in the central bank’s discount rate, a significant currency fluctuation, the company’s performance falling short of the target, and so on. The app should instantly calculate the consequences of such events for users’ businesses and notify them. Notifications will benefit the app a lot, so make them user-friendly.

4. Custom Visualization of the Data

The financial app generates a lot of information for management decisions. High-quality visualization is indispensable here.

It is possible to implement a set of 100+ dashboards for various purposes in one app module. A three-level system is suggested:

- Basic default set of dashboards

- Possibilities of customizing dashboards and creating, based on guidelines, additional visualization patterns that the user can save and use in the future

- Automated visualization with a focus on specific niches/domains/aspects of the company’s activity and target user categories. For example, the app generates a set of infographics analyzing staff costs every quarter and sends them to stakeholders.

5. Mobile First Approach

How to properly understand and apply such an approach? Of course, some users will still prefer a laptop when making payments via the app. But let’s venture far enough to assume that the market will ignore a financial app that is hard to use on the go, in between meetings, and so on. Money management solutions for companies need to either be mobile-friendly or not appear at all.

Consequently, all financial information should be organically and conveniently displayed on a smartphone screen, including notifications, dashboards, and more. Custom settings and data processing should also not be damaged or distorted. Such an issue is quite a challenge for developers and designers. We are ready to handle such a challenge and will willingly help you with it.

AI Analytics Module in Small Business Money Management Apps

Advances in AI can greatly enrich the functionality of a financial app for business. Make sure to use these killer features!

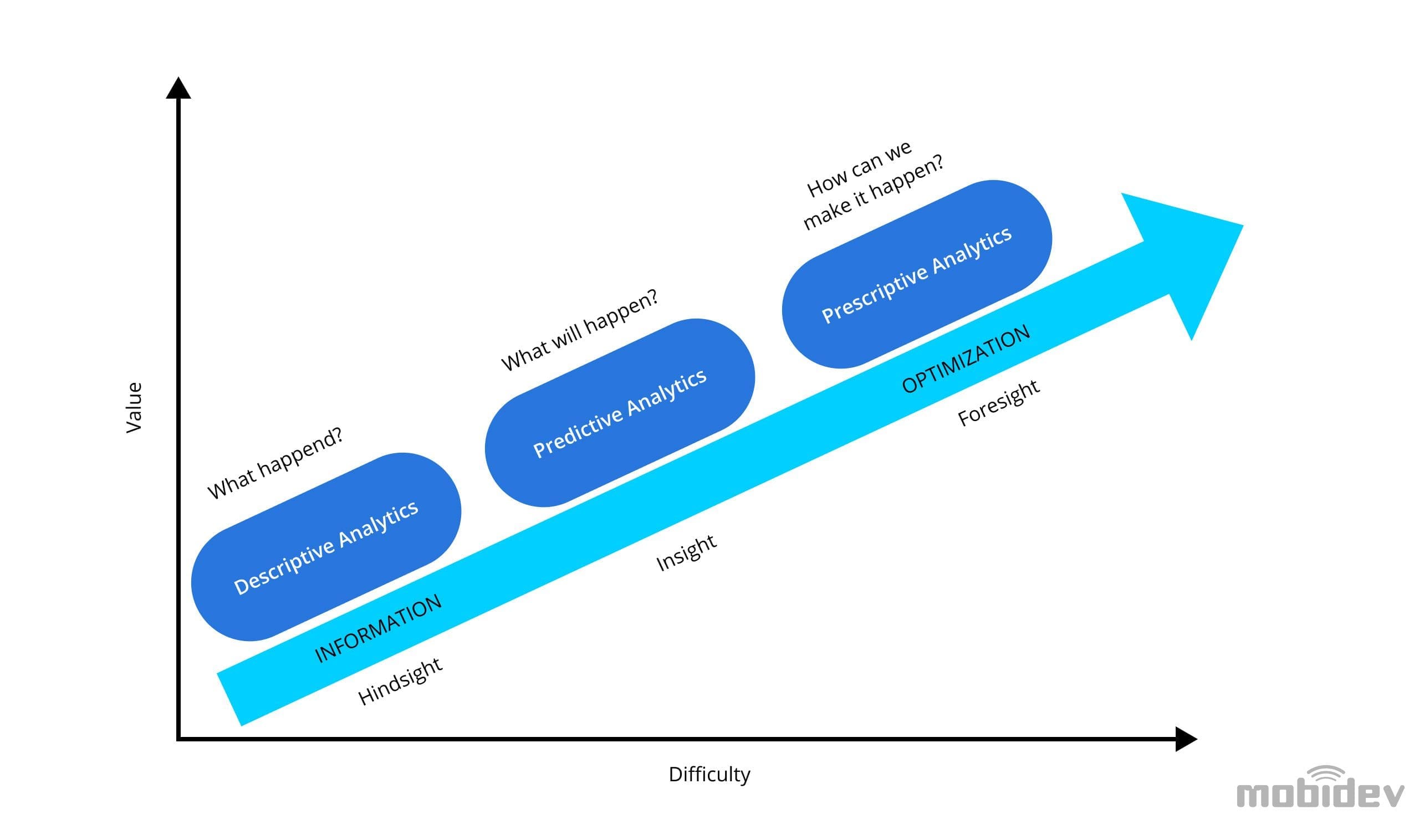

AI-based analytics is a powerful capability for money management solutions for companies.

AI models make it possible to predict future income and expenses. The starting point is historical data. It is also possible to trace the relationship and impact of changes in the external economic environment on the company’s financial condition. In this way, the developers improve the models, and the forecasts obtained on their basis become more accurate. Such models are essential for predictive analytics.

To make it easier to understand the different types of analytics and model levels, note the following:

- Descriptive analytics dissects what has already happened

- Predictive analytics show us what might happen with some probability

- Prescriptive analytics considers all possible factors of the scenario and suggests actionable plans, highlighting the best among them

Nowadays, it is realistic that the AI-analytical module is not limited exclusively to prediction. It is about generating different recommendations and even different financial management scenarios. Then you will need an even higher-level toolkit – prescriptive analytics.

You can read more about how AI-driven decision-making algorithms work.

As you can see, the AI-powered corporate financial assistant has far surpassed its “pre-AI” predecessors. Let’s consider some more details of creating such financial apps.

What is Crucial to Consider When Creating AI Budgeting Apps?

We figured out the technical side of creating an AI-powered financial app. In the meantime, don’t overlook other aspects of bringing your app to market.

1. COMPLIANCE WITH REGULATORY LAWS

Regulatory practices have significant differences across regions. Therefore, the issue of regulatory compliance is one of the challenges for a startup founder. For example, the US does not yet have a unified regulatory system for automated systems in the financial sector at the federal level. Such a feature influences the financial app development for this market.

Familiarity with federal financial services laws (such as Anti-Money Laundering (AML) regulations) is mandatory. Additionally, you will have to pay attention to the local laws of the states.

In Europe, your financial app has to comply with a whole series of regulations. Are you aware that, for example, an app related to any payment service in the European Union must use multi-factor authentication for user login? It is high time to mention the AI features we wrote about above.

We strongly advise you to research the regulatory environment of the region whose residents will use your financial app. Then your efforts on the technical and business aspects of an AI money management app’s development will not go to waste. The technologies we can offer you will ensure your app’s regulatory compliance.

2. EXPERIENCED DEVELOPMENT TEAM

Developing AI-based financial applications is more elaborate than conventional ones. Such a project team additionally needs in-depth AI expertise.

When negotiating with a team about creating an application, check out examples of their AI-powered projects. Ask if the potential contractor has all the necessary specialists in all parts of budget app development, including AI. Note also the necessary data expertise as AI works with large amounts of data. Analyzing case studies of similar projects will help you make a good choice. Take a closer look at the people behind every project and choose the right people to bring your business idea to life.

How MobiDev Can Help You with Financial App Development

At MobiDev, we follow a clear delivery flow that includes deep project research before starting work. Due to this, we are always confident that the development team and the client share the project goals and have a common vision of the result. You can be more focused on the project’s marketing and finances because we will shoulder all the technical issues.

A complete set of technologies you might need for making a budget app is already on standby. MobiDev has repeatedly topped the lists of the best AI/ML providers, according to Clutch, Techreviewer, and GoodFirms.

We have in-house experts in AI/ML, blockchain, mobile apps, web development, BA, UX/UI design, etc., who will get to the heart of your idea and embody it in the app.

The priority of building AI functionality is beneficial to customers. Common sense tells us to start the construction from the foundation, that is, AI features. The rest is a technical matter and similar to developing any other software.

That`s why at MobiDev, AI money management app development consists of two main parts:

1. Creation of AI modules. Together with you, we should first assess what value can be created from your ideas and collected data. We will verify the potential of your data and ideas to develop and train ML models. The option of customizing a ready-made solution is also worth considering.

2. Building the infrastructure in which these modules operate. Once you’re confident in the capabilities of your app’s AI modules, we’ll complete the development.

Let us get to know your product vision. We will discuss it and agree on the requirements. After that, we will offer detailed steps for developing a financial app.

MobiDev can become your development team to create a technical project plan, both for its presentation to your investors and for further implementation. Contact us, and we will be glad to get on board.