Contents:

As a fintech market analyst, I spend a lot of time researching financial market trends. Additionally, as a BA Team Lead at MobiDev, which has been developing software products since 2009, I get a clear idea of how this or that trend can meet the real needs of a specific business and become the basis of an effective software solution.

Recognizing the synergy between these two areas, I decided to combine my experiences and share with you my take on the latest fintech innovations and what it takes to start implementing them.

TOP 6 GLOBAL FINTECH INDUSTRY TRENDS IN 2026

Before diving into specific fintech areas, let’s take a look at the general fintech industry trends that are game-changing for the financial technology scene and check some market statistics.

1. EMBEDDED FINANCE EXPANDS SERVICES RANGE

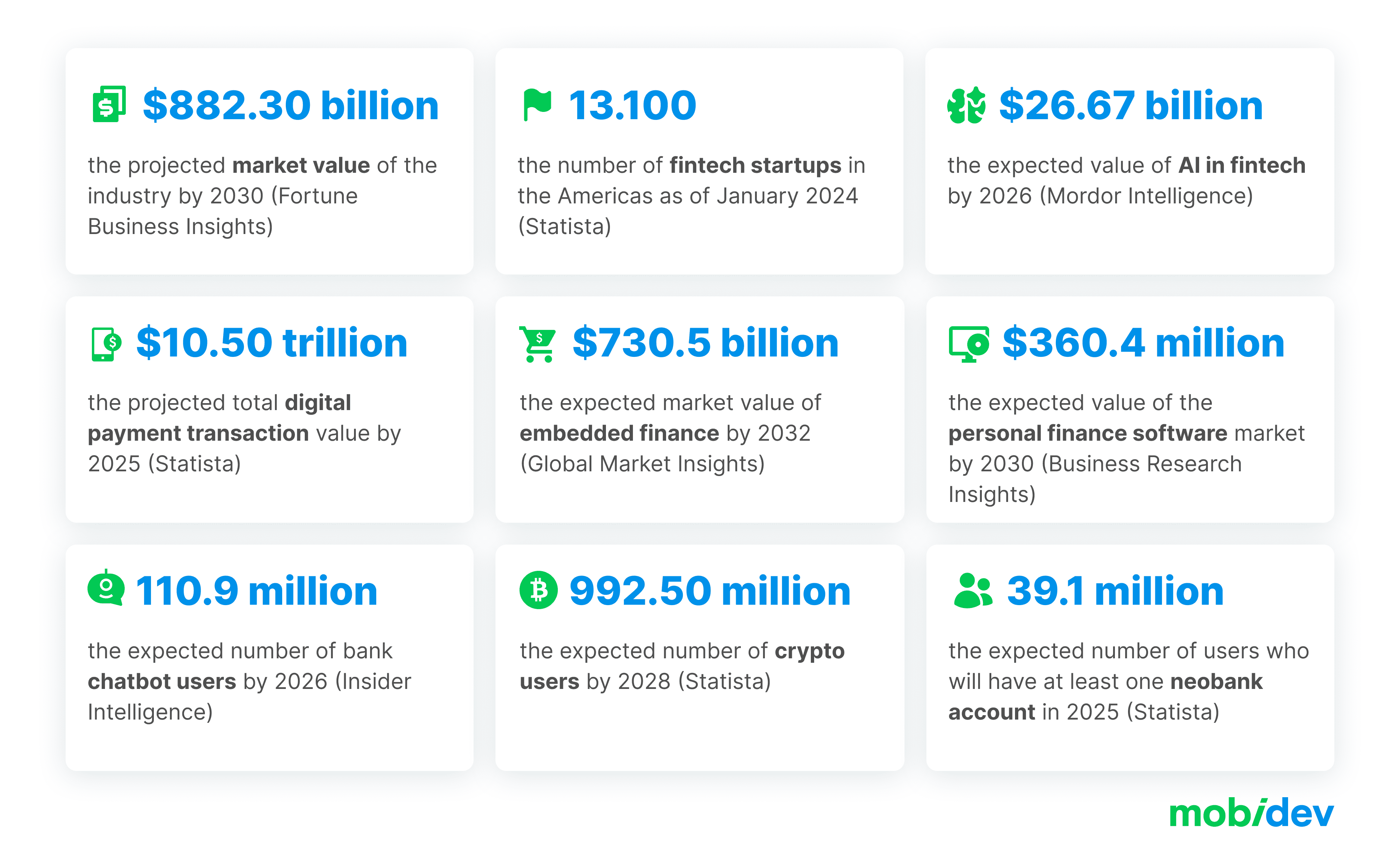

Embedded finance has been booming in recent years, reaching a value of $58 billion in 2022, and poised to reach $730.5 billion by 2032, according to Global Market Insights. The ability to integrate financial services into non-financial products, be it a social media platform, flight booking site, or something else, showed its effectiveness for all parties involved.

Service providers get opportunities to enhance customer experience and address their real-time needs. Banks open new revenue streams, and customers get greater access to financial services exactly when they need them.

The growing number of embedded financial APIs is fueling that trend. Using APIs allows developers to easily integrate banking and payment services into their applications, reducing deployment time and costs. The EU’s Payment Services Directive 2 (PSD2), which encouraged banks to open access to their customer accounts and data with customer consent, made this a common case in Europe.

Nevertheless, security remains the primary focus for embedded financial platforms. Both financial service providers and embedded finance adopters must implement robust security strategies and safeguards to protect their users’ sensitive data.

How to leverage this trend:

- Banks need to develop a clear embedded financing strategy that can help them expand their products and services through third-party platforms. This should include integration and partnership plans, regulatory considerations, risk management, infrastructure requirements, and more.

- Companies that want to include embedded finance in their applications should research exactly what financial services will benefit their users (payment, lending, insurance, etc.).

Tech Consulting Services

Get a clear tech strategy for driving innovation into your fintech business to achieve your strategic goals

Contact us2. BIOMETRIC AUTHENTICATION ENHANCES SECURITY

With the increasing pressure of cyberattacks on fintech, and with the average cost of a data breach reaching $4.45 million in 2023, financial companies must constantly work on more complex authentication and authorization mechanisms. Biometrics authentication is still one of the most reliable security methods since it relies on unique user data that is difficult to fake.

Fingerprint scanners, facial and voice recognition technology, and iris scanners in fintech are used for customer onboarding, user authorization, confirming payments and accessing sensitive data. Several types of biometrics are often used. For example, Revolut, HSBC, Bank of America, and others, provide their users with options to log in to their accounts using fingerprint or facial recognition on their mobile devices.

Unfortunately, progress plays into the hands not only of business but also of fraudsters. The development of generative AI facilitates, among other things, synthetic identity fraud. Fintech companies must provide additional layers of protection with “liveness detection” that differentiates human consumers from synthetic AI-generated identities.

Below you will find how artificial intelligence algorithms can prevent this from happening in the example of face recognition.

How to leverage this trend:

- Fintech providers should evaluate the feasibility of implementing biometrics within the bank’s existing infrastructure, assessing factors such as regulatory compliance, cost considerations, and potential integration challenges.

- The next step is to identify the appropriate biometric modality and start with a small MVP to evaluate the effectiveness of the new solution.

3. ARTIFICIAL INTELLIGENCE MAKES FINANCIAL OPERATIONS SMARTER

Fintech solutions involve a great deal of data, and there’s no better technology to handle all that data than artificial intelligence. AI helps with a number of areas of fintech, like risk management, fraud prevention, document processing, decreasing operating costs through optimization, and personalizing the banking experience for customers.

The fintech market is full of AI application cases. The Royal Bank of Canada uses the power of AI innovations to improve user experience and deliver new applications to customers faster.

PayPal announced that in 2024, the company was going to bring to market six new features designed to simplify the checkout process and introduce personalized recommendations based on artificial intelligence.

In early 2024, JPMorgan Chase introduced DocLLM, a large language model designed specifically for reading complex financial documents that have text and spatial modalities.

These are just a few cases and the list can go on and on. According to Mordor Intelligence, AI in the fintech market is expected to grow from $7.91 billion in 2020, to $26.67 billion by 2026.

How to leverage this trend:

- Since AI projects are associated with uncertainties, starting with AI consulting is recommended to find the best match between your business goals, market needs, and technology capabilities.

4. PERSONAL FINANCE APPS TAKE THE MARKET BY STORM

Rising consumer financial awareness has fueled the growth of the personal finance software market, which is expected to reach $360.4 million by 2030, up from $199.7 million in 2022, according to Business Research Insights.

By end user, the market is represented by solutions for individual consumers, family financial applications, and platforms for small businesses. By functionality, there are spending tracking apps, as well as budgeting and investment apps, although more often solutions combine the features of several types and are offered to users as financial assistants.

Check out the demo version of the family finance app created by the experts at MobiDev to see what such a solution might look like.

Although money management apps appear mostly as startup solutions, established financial institutions are increasingly turning to personal finance app development services to build their own budgeting apps or partnering with startups to diversify their offerings. For example, Capital One added budgeting tools to its app along with a built-in virtual assistant called Eno. Users can ask Eno to provide a list of their recent transactions, savings progress, etc.

Chase, Wells Fargo, Bank of America, and other companies also have their own mobile applications with personal finance management functionality.

How to leverage this trend:

- Banks and other financial institutions can develop personal finance management apps as a part of their existing infrastructure or partner with promising fintech startups through an open banking framework.

5. CHATBOTS AND VIRTUAL ASSISTANTS PROVIDE PERSONALIZATION

Thanks to the development of Generative AI algorithms such as Chat GPT, chatbots and virtual assistants are gaining more popularity in fintech. According to Insider Intelligence, in 2022, there were over 98 million bank chatbot users. This number is expected to grow to 110.9 million users by 2026.

Virtual assistant technology is also booming. Currently, the most advanced AI financial virtual assistant is Erica from Bank of America. Launched in 2018, Erica surpassed 1.5 billion customer interactions last year. The success of this virtual assistant is backed by continuous improvements, which currently satisfy both simple requests of bank users, such as accessing account information, transferring money between accounts, finding the nearest ATM, and more complex financial needs, such as understanding spending habits, managing subscriptions and checking FICO score.

Chatbots and virtual assistants not only provide evident advantages to customers, but also play a crucial role in helping financial institutions minimize their operational expenses. Additionally, there is a notable presence of standalone virtual financial assistant applications like Cleo, QuickBooks, Mint, YNAB, and more in the market. Such applications usually allow users to integrate these tools with their bank accounts and receive up-to-date data about their accounts, expenses and income.

How to start with this trend:

- Fintech institutions can both integrate ready-made chatbot solutions and create custom virtual assistants. Therefore, it’s best to start by identifying your requirements, studying the existing solutions on the market, and correlating their possibilities with your business needs.

- Entrepreneurs can build a business around a personal or corporate finance management app by finding insights in our guide below.

6. FINTECH MOVES TOWARD SUSTAINABILITY

The global sustainability trend has not bypassed fintech, resulting in a growing number of green awareness initiatives. For example, the crypto market continues to develop green cryptocurrencies designed to address the energy consumption issues of traditional cryptocurrencies, such as Bitcoin, through a more efficient consensus mechanism. Already, more than 200 companies and individuals have joined the Crypto Climate Accord initiative, launched in 202,1 with a mission to decarbonize the industry and achieve zero emissions from cryptocurrency-related electricity consumption by 2030.

Digital wallets and contactless payments allow users, among other things, to eliminate the need for paper cash. For example, the German-based company Ecosia, funded Treecard, a company that released a debit card made from sustainable cherry wood combined with an app that helps users track their spending and make more ethical purchases. The company invests about 80% of the profit received from transaction fees into tree planting.

How to start with this trend:

- Fintech companies need to develop effective sustainability strategies, including measurable sustainability goals, timelines, and resources needed to integrate the strategy into day-to-day operations.

- This may involve efforts of environmental and social impact specialists, data analysts, legal advisors, software engineers, and more.

TOP 4 Fintech Payment Trends In 2026

When talking about the biggest trends in fintech, we can’t overlook payments. The widespread adoption of open banking continues to drive the growth of digital transactions across Europe. In response, the European Union is advancing key regulatory updates. The Instant Payments Regulation (IPR) officially came into force in April 2024, with payment service providers required to support instant euro transfers—receiving by January 2025 and sending by October 2025.

Meanwhile, PSD3 and the new Payment Services Regulation (PSR) are in the final stages of legislative negotiation, with adoption expected in late 2025. These updates will introduce mandatory verification of payee, stricter Strong Customer Authentication (SCA) rules, and enhanced fraud prevention mechanisms, laying the foundation for a safer, faster, and more transparent payments ecosystem across the EU by 2026–2027.

1. CONTACTLESS PAYMENTS ARE ON THE RISE AFTER THE PANDEMIC

The contactless payment trend that gained momentum during COVID-19 has proven its effectiveness in the post-pandemic world and continues to grow. The market is expected to reach over $132.42 billion by 2032, led by Europe. QR code, NFC and wearable payments are still on the rise, but the list of payment options is expanding with even more innovative solutions.

For example, in 2022, Mastercard launched a pilot biometric payment feature that allowed users to pay in-store by showing their face to the device’s camera or waving their hand over a sensor. Last year, the company strengthened this initiative by partnering with NEC Corporation, which provides the biometric matching and liveness detection algorithms.

In March 2023, JPMorgan Chase & Co. also announced that it plans to test a similar feature. If the pilot is successful, the company promises a wider rollout of biometric payments for US customers in 2024.

In March 2023, JPMorgan Chase & Co. announced plans to test a biometric payment feature using facial and palm recognition. Following successful pilot programs at selected retail locations and events, the company initially aimed for a broader rollout in 2024. However, the timeline has since shifted. JPMorgan now plans a full U.S. merchant rollout in the second half of 2025. Broader adoption of palm-vein biometric technology is expected to follow in 2026.

2. A2A PAYMENTS HELP MERCHANTS REDUCE FEES

Account-to-account payments, which were previously available through systems like ACH (Automated Clearing House network), are making a comeback thanks to open banking. A2A payment enables money transfers from one bank account to another without the involvement of bank intermediaries.

Since A2A payments combine open banking and real-time payments, this payment method offers improved transaction speed and reduced transaction costs, which is especially beneficial for international transfers. Companies use A2A payments for both business-to-business and consumer-to-business transactions. For example, a company can integrate A2A payments into their POS solutions and allow consumers to pay to their bank account in-store without any fees for card processing.

Although account-to-account payments may cause a decrease in revenue from card fees for traditional financial institutions, the shift from card payments to “pay-by-bank” is a great opportunity for the development of new innovative solutions on the market. So it’s no surprise that, according to the Global Payments Report 2023, global A2A transaction value reached $525 billion in 2022 and is projected to grow at 13% CAGR by 2026.

3. CRYPTO DIVERSIFY PAYMENT OPTIONS

Cryptocurrencies have long ceased to be considered alternative finance options and are playing an increasingly prominent role in the fintech sphere, with around 30,000 merchants worldwide currently accepting Bitcoin, according to Cointelegraph Research. Although price volatility is still one of the biggest challenges to the adoption of crypto payments, the development of stablecoins and crypto processing service providers with built-in risk mitigation mechanisms allows the market to grow. The number of crypto users is expected to reach 992.50 million users by 2028, according to Statista.

Responding to the growing demands of users, fintech companies are implementing crypto-friendly strategies. For example, Revolut provides crypto trading options within its mobile app and support for over 30 cryptocurrencies. Ally Bank allows customers to use their accounts with external crypto exchanges for trading. JP Morgan Chase went further by introducing JPM Coin for instant cross-border payments in 2019, which was used for approximately $1 billion worth of transactions every day in 2023.

4. BNPL PROMOTES BUSINESS DEVELOPMENT

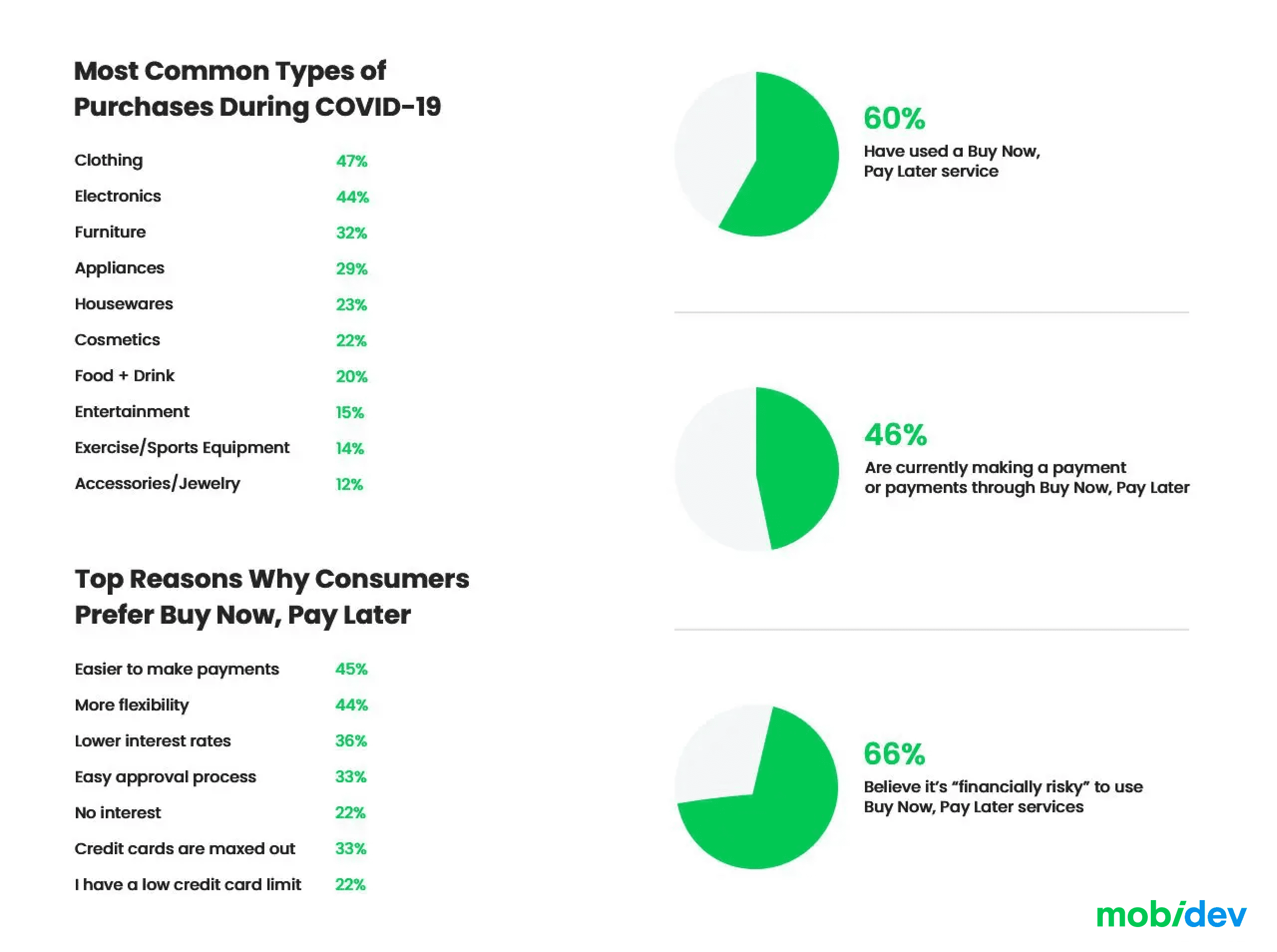

Experts predict a boom in the buy-now-pay-later sector, and global giants are already following this fintech trend. For example, Amazon is partnering with Affirm to implement BNPL by splitting purchases of $50 or more into smaller monthly payments. In 2023, Google Pay announced a pilot BNPL program with Affirm and Zip too.

The BNPL market is expected to grow from $156.58 billion in 2023 to $232.23 billion in 2024, as more and more businesses implement this option into both online and offline offerings. According to the latest survey data, 43% of consumers indicated that they might reconsider purchases if BNPL was not available. You can find more fascinating statistics below.

However, despite all the advantages of BNPL, the US financial regulators urge banks to be careful and consider the risks when implementing such strategies. In particular, the current lack of regulation in this area can cause misunderstandings between clients and institutions and loss of money. Therefore fintech institutions are advised to have clear policies that are transparent and informative for all parties of BNPL loans.

TOP 3 Fintech Banking Trends 2026

Recent years have given us some exciting new trends in fintech that have affected the banking industry. The increased demand for digitalization and the growing adoption of technologies have pushed traditional banks and fintechs to cooperate to jointly develop the market and improve the quality of financial services.

1. OPEN BANKING EXPANDS BANK ECOSYSTEM

Open banking was repeatedly mentioned in this article as a catalyst for the development of other trends. The adoption of PSD2 in Europe in 2015 opened up a joint development branch of fintech startups and traditional banks, and the results of this cooperation are becoming more significant every year. Market giant JPMorgan is an example of a company that regularly collaborates with fintech startups to create new financial products. As of 2023, the bank’s partnership and investment network includes more than 20 businesses in segments such as payments, lending, digital banking, and banking infrastructure.

Open banking strategies are being actively implemented in other regions outside the EU. For example, Australia and Hong Kong have open banking regulations, while other countries, including the United States, follow a market-based approach without government initiatives. However, things are about to change soon. At the end of 2023, the Consumer Financial Protection Bureau (CFPB) proposed a Personal Financial Data Rights rule, which carries the regulatory background for more rapid development of open banking in the states.

At the heart of the idea of open banking is API development, which allows financial companies to transmit financial data securely. However, using such APIs still involves challenges, primarily related to regulatory compliance and the development of robust security mechanisms. Also, developers must provide a high level of interoperability and API standardization, which ensures efficient data exchange between different financial parties.

In any case, one thing is clear, open banking has huge potential for the development of the fintech market and is only in the early stages of its growth. The numbers confirm this. According to Allied Market Research, the global open banking market is projected to reach $123.7 billion by 2031, up from $13.9 billion in 2020.

2. NEOBANKS OFFER MOBILE-FIRST SERVICES AT LOWER COST

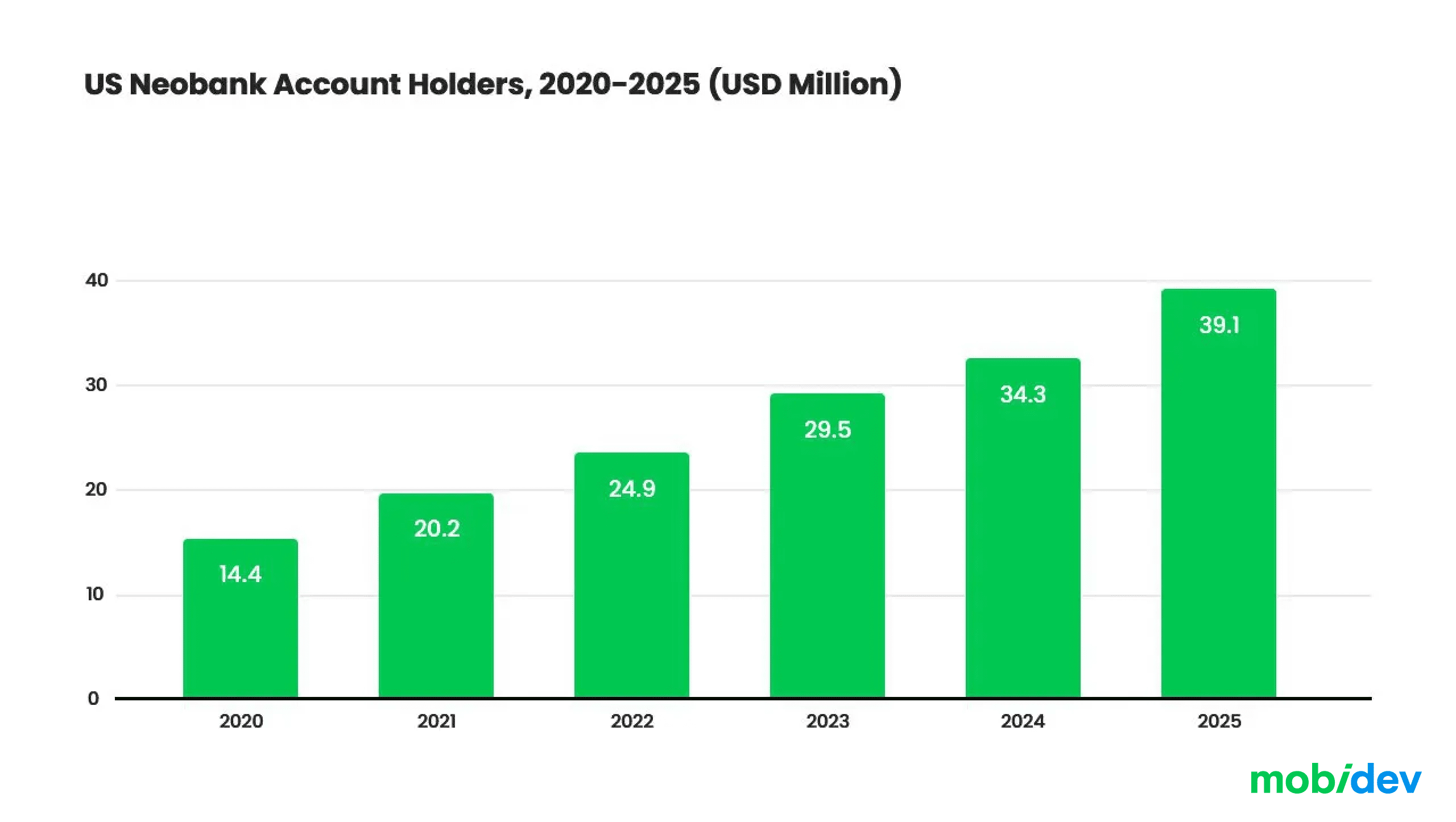

Neobanks were successful due to their valuable features during the COVID-19 pandemic. Instant transfers, fast registration, and IBAN and ACH accounts offering entirely online banking access were beneficial during a time when remote work was a necessity for many industries. Now that the world is recovering from the pandemic, interest in this trend has not faded. Many users have appreciated the advantages of neobanks and are ready to continue to cooperate with them.

The US is a leader in neobanking transactions. According to Statista, the number of individuals who hold at least one account at a neobank in the US is expected to peak at 39.1 million in 2025, up from 20 million in 2021.

The European neobanking market is also growing. According to Global Market Insights, its CAGR is projected to reach 45% by 2028.

The neobanking market is quite competitive, as it is represented by both established fintechs and startups. The most famous among them are Revolut, N26 and Monzo. In turn, the rise of neobanks is forcing traditional financial institutions to invest heavily in digital transformation to improve their online and mobile banking capabilities to stay competitive. By applying innovation and partnership with neobanks, they aim to deliver a competitive offer while leveraging existing strengths in regulatory compliance, brand recognition and customer trust.

Learn more about how to improve mobile banking app features and UX design in the video below.

3. BANKING-AS-A-SERVICE BOOSTS THE MARKET GROWTH

Banking-as-a-service (BaaS) allows banks to open access to their payment ecosystem to companies that want to provide financial services and build their products on top of traditional banking infrastructure. Thus, non-banks can provide financial services without the need for a banking license. BaaS also takes advantage of APIs, but unlike open banking, it provides a third party not with ready-made data, but with the functionality of a bank based on which a new product can be developed.

With the growing interest in BaaS, the list of key market players is growing. Railsr, Solarisbank, Galileo, and Treezor are at the forefront of this fintech area, but new BaaS providers are popping up all the time. According to Market Research Future, the BaaS market is expected to reach $65.95 billion by 2023, up from $21.47 billion in 2022. Due to advanced open banking regulations and the growing adoption of digital payment systems, Europe is expected to be the largest market for BaaS development in the coming years.

THE FUTURE OF THE FINTECH INDUSTRY IN 2026 AND BEYOND

If we try to find something in common in all fintech trends, then we can identify 3 factors that drive the development of the industry and which must be taken into account by companies wishing to succeed in this area.

- Regulatory compliance. In 2026, more attention is expected to be paid to regulatory compliance and fintech firms need to catch up with quickly evolving financial legislation. Adapting to these changes will be critical for long-term success. If available, consider operating in regulatory sandboxes that allow the testing of innovations in a controlled environment.

- Blurring of boundaries. As customer expectations rise, the most successful companies are looking to provide more comprehensive services without limits. For example, profitable international payments, the ability to trade crypto, stocks, loans, and more, all within one application. Providing users with the entire range of financial services through one platform is a huge competitive advantage for fintech companies.

- Increasing accessibility of financial services. Fintechs strive to make their services for customers as simple and accessible as possible. This includes simplifying and speeding up the process of buying stocks, quickly calculating interest on a loan, issuing insurance in a few clicks, and etc.

Companies that can make progress in these three areas are most likely to be the main market players in the near future. Furthermore, as demonstrated by the examples provided in this article, the most successful companies amalgamate multiple trends within their innovative strategies, yielding enhanced outcomes.

Getting started with incorporating fintech trends is the most important step. With the right team, you can create a fintech app that will keep your business competitive in a fast-changing industry or innovate your existing solution.

If you have a fintech product idea in mind and you are looking for a development team that can guide you as you build an app that fits market needs, think about starting cooperating with MobiDev. Learn more about our fintech software development services and contact us to discuss how we can meet your business goals.