Client and Business Goals:

Did you know that the lack of financial literacy costs Americans, including 75% of millennials, around $400 bln a year? The frustrating statistics of the prospective family finance market niche brought a US-based startup founder to the idea of launching a fintech app aimed to bring clarity to the process of budget allocation and planning.

Product Description:

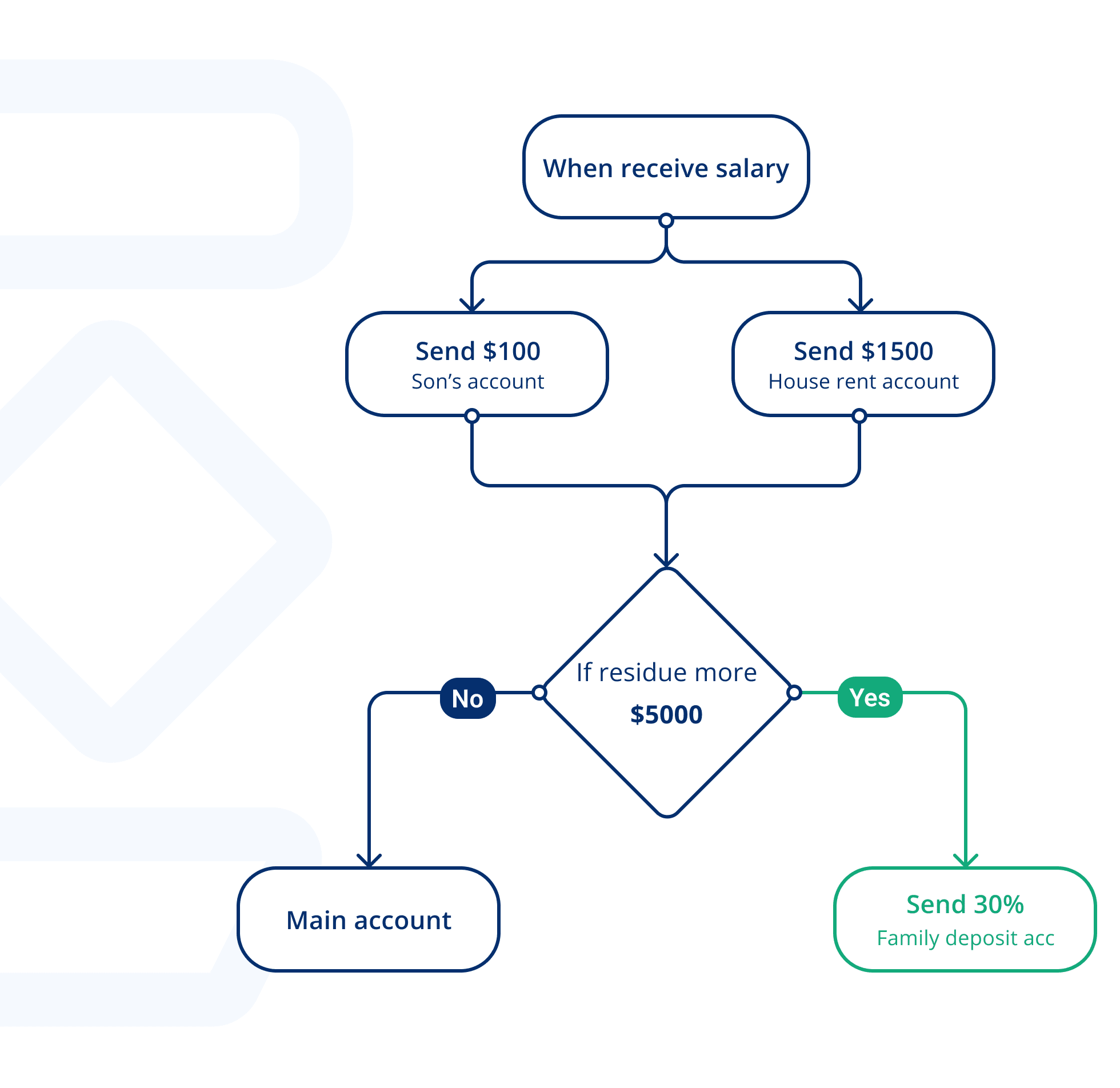

The cross-platform mobile app is designed to tidy up a family budget and simplify the process of finance allocation, in particular, for saving accounts. The family members’ accounts and cards form the family finance network while all personal finance data remains private. The app automatically calculates and transfers standing payments & replenishes a deposit, based on the rules pre-set by the user. Additionally, the implemented permission levels allow parents to share only selected financial data, as well as get full access to tracking children’s balances and give recommendations on a rational budget allocation from a very young age.

Applied Technologies:

AWS: Elastic Beanstalk, EC2, RDS (PostgreSQL), Lambda, L3 LoadBalancer

Backend: Python, Go/NodeJS

Frontend: Flutter, Micro Frontend (Angular, ReactJs)

External Services: Plaid, Auth0